#Multi-timeframe candlestick pattern strategy

Explore tagged Tumblr posts

Text

How to Trade the Bearish Engulfing Pattern: Complete Guide with Strategies and Examples

Candlestick patterns are powerful tools in the arsenal of a technical trader. Among the most reliable reversal patterns is the Bearish Engulfing Pattern—a strong signal that can hint at the start of a downward trend. In this guide, we’ll explain how to identify this pattern, why it works, and most importantly, how to trade it effectively with multiple strategies and examples. 📌 What is a Bearish…

#Bearish candle formation#Bearish engulfing candlestick pattern explained#Bearish Engulfing Pattern#Bearish engulfing pattern trading strategy#Bearish reversal pattern#Bearish trend confirmation#Can you trade bearish engulfing in forex?#Candlestick pattern for bearish reversal#candlestick patterns#Confirmation signals for bearish engulfing#EMA confluence with candlestick patterns#Engulfing candle trading rules#Entry and exit with candlestick patterns#Forex bearish engulfing strategy#How to confirm a bearish engulfing signal?#How to trade the bearish engulfing pattern#Is the bearish engulfing pattern reliable?#learn technical analysis#Multi-timeframe candlestick pattern strategy#Price action trading setup#Reversal Candlestick Patterns#Risk management for pattern trading#stock markets#Stock trading with bearish engulfing pattern#support and resistance levels#Swing trading with bearish engulfing#technical analysis#Trading bearish engulfing with moving averages#Trading Strategies#Using bearish engulfing with RSI

0 notes

Text

what is the best indicator for trend reversal

🔁 What Makes a Good Reversal Indicator in Forex Trading?

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

Introduction

In forex trading, timing the beginning or end of a trend can be a game-changer. While trend-following strategies help traders ride the momentum, identifying a trend reversal allows them to enter early and capture larger price moves. However, spotting reversals is far more challenging than following trends. This is where reversal indicators come into play.

But not all indicators are created equal. Many promise precision but deliver false signals. So what actually makes a good reversal indicator? In this detailed article, we'll explore the critical qualities that define reliable reversal indicators, how they work, and which ones meet these standards. Whether you're a beginner or an experienced trader, understanding these principles will improve your ability to spot and trade reversals confidently.

Why Reversal Indicators Matter

Reversal indicators are technical tools designed to alert traders when the current trend is losing momentum and possibly preparing to change direction. The earlier you can detect a potential reversal, the better your entry point and risk-to-reward ratio.

For example:

In a downtrend, entering long (buy) at the reversal point allows traders to profit as the market turns upward.

In an uptrend, identifying when momentum is fading can help traders short at the top, catching the move down.

Accurate reversal detection is especially critical for:

Swing traders: who aim to catch medium-term movements.

Scalpers: who require pinpoint entries on lower timeframes.

Position traders: who want to avoid entering at the end of a trend.

However, not all reversal signals are worth acting on. That’s why it’s important to understand what makes a reversal indicator trustworthy.

Core Features of a Good Reversal Indicator

Here are the key characteristics that define a reliable reversal indicator in forex trading:

1. Timely Signal Generation

A good reversal indicator provides early signals before or near the beginning of the reversal — not after the price has already moved significantly.

Too early = false signal

Too late = missed opportunity

It must strike the right balance. It should not just lag behind the price but rather react to weakening momentum, divergence, or changes in price structure.

2. High Signal Accuracy

Accuracy is crucial. A good indicator must:

Minimize false signals

Confirm only high-probability setups

This doesn't mean it has a 100% success rate, but the win-to-loss ratio should be favorable when used properly. It should provide clear, unambiguous signals—not constant alerts that leave traders confused.

3. Clarity and Simplicity

An effective reversal indicator is easy to interpret, especially under real-market pressure. Indicators that rely on overly complex calculations or hard-to-read visuals can lead to poor decisions.

Example:

An RSI indicator showing divergence at oversold levels is straightforward.

An exotic oscillator with dozens of settings might confuse traders unless fully mastered.

4. Compatibility with Price Action

Reversal indicators work best when they align with price action principles like:

Support/resistance zones

Candlestick patterns

Trendlines or chart structures

A reversal signal becomes far more reliable when the indicator and price behavior agree.

5. Multi-Timeframe Usefulness

A good reversal tool should function well across different timeframes:

On H4/D1 for swing traders

On M15/M5 for scalpers

It should also align on higher timeframes for better confirmation (e.g., if an indicator shows reversal on H4 and H1, the signal is stronger).

6. Works with Trend & Counter-Trend Trades

While reversal indicators are primarily used to catch tops and bottoms, the best ones can also be used:

For pullback entries during trends (minor reversals)

To confirm trend continuations after fake-outs

This flexibility is a sign of a mature and tested tool.

7. Backtest Proven

The best indicators are not based on hype but data. A good reversal indicator should:

Be backtested on different pairs and conditions

Show consistent performance

Work during ranging and trending markets

Indicators with solid historical performance are more likely to succeed in live environments.

Technical Foundations of Reversal Detection

A reliable reversal indicator often works based on one or more of the following principles:

🔁 1. Momentum Shifts

Indicators like RSI, MACD, and Stochastic Oscillator detect when momentum is fading, often before price turns.

Bearish divergence (price makes higher highs, RSI makes lower highs) indicates weakening bullish momentum.

Bullish divergence (price makes lower lows, RSI makes higher lows) suggests a bullish reversal.

📉 2. Overbought/Oversold Conditions

Oscillators that measure how "stretched" a price is — like RSI and Stochastic — help traders spot points where price is likely to snap back.

Example:

RSI > 70 = overbought → potential sell

RSI < 30 = oversold → potential buy

🧱 3. Break of Market Structure

Indicators that detect support/resistance breakouts or trendline breaks can highlight early reversals. Tools like Fractals, ZigZag, or price structure break alerts are useful here.

📈 4. Volume Confirmation

Volume indicators like On-Balance Volume (OBV) or Volume Spike detectors show whether large traders are entering or exiting positions, signaling potential reversals.

Examples of Good Reversal Indicators

Let’s look at some indicators that meet most of the criteria above:

✅ 1. Relative Strength Index (RSI)

Tracks momentum and overbought/oversold zones.

Works well with divergence for reversal spotting.

Best when combined with price action or support/resistance levels.

✅ 2. MACD (Moving Average Convergence Divergence)

Shows momentum shifts and crossovers.

Divergence between MACD and price is a strong reversal signal.

Smooths out price noise but may lag slightly.

✅ 3. Stochastic Oscillator

Shows where price closes in relation to its range.

Good for catching short-term reversals in ranging markets.

✅ 4. Bollinger Bands

Price touching the outer band (especially with divergence) often leads to reversal.

Bollinger Band Squeeze also predicts breakouts and reversals.

✅ 5. Candlestick Patterns

Not a technical “indicator” in the traditional sense, but very reliable when combined with indicators.

Examples: pin bars, engulfing candles, morning star, doji at support/resistance.

Combining Indicators for Better Accuracy

The best results come not from relying on one indicator, but from combining 2–3 tools that complement each other. For example:

🔁 RSI + MACD + Price Action

RSI divergence → early warning

MACD crossover → momentum confirmation

Bullish engulfing candle → entry signal

🔁 Stochastic + Bollinger Bands + Support/Resistance

Stochastic shows overbought near resistance

Price breaks above outer Bollinger Band

Resistance zone confirms → short trade setup

This confluence method greatly improves reversal accuracy.

Real-Life Scenario Example

Imagine you're trading EUR/USD on the H1 chart.

Price reaches a strong resistance zone.

RSI is above 70 and shows bearish divergence.

MACD histogram starts turning down.

A bearish engulfing candle forms.

This multi-layered setup is a textbook reversal signal.

Backtesting Reversal Indicators

Before using a reversal indicator in live trading, it should be backtested over:

At least 100 trades

Multiple currency pairs

Various timeframes

Track:

Win rate

Average risk-reward

Frequency of signals

Maximum drawdown

This helps verify whether the indicator provides real edge or just looks good on static charts.

Recommended tools:

MT4 strategy tester

Soft4FX simulator

Excel journal tracking

Reversal Indicators to Avoid

Some indicators look good on paper but often fail in live trading due to:

Lagging nature (e.g., MA crossovers give late signals)

Too many false signals (e.g., unfiltered oscillators)

Incompatibility with volatile pairs

Unclear entry/exit rules

Avoid indicators that:

Don’t work across markets

Are repainted (change values after the bar closes)

Are black-box tools without transparency

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex#forex broker#forex online trading#forex education#forex news#forex market#forex factory#forex indicators#forex ea#crypto#digitalcurrency#bitcoin#altcoin#blockchain

1 note

·

View note

Text

Learn, Trade, Succeed – Discover the Complete Trading Education by Chart Monks

Are you tired of hopping from one YouTube video to another, still confused about how the stock market really works? At Chart Monks, we’ve created a complete trading education platform that takes you from clueless to confident—whether you’re a complete beginner or someone looking to refine advanced strategies.

With our trading courses for beginners and advanced modules like the psychology of trading and technical analysis stock market course, we provide the structured learning that most traders miss.

Why Choose Chart Monks for Your Trading Journey?

Unlike most platforms that give you scattered lessons or overly complex theories, Chart Monks simplifies trading education. Our courses are structured, easy to follow, and practical—built by real traders for real people.

We offer:

Basic Trading Course for absolute beginners

Hindi Trading Course to break the language barrier

Advanced modules like the silent language of markets and stock market technical analysis course

Live mentorship and doubt-clearing sessions

Affordable pricing and lifelong access

Start with the Basics – Our Trading Courses for Beginners

If you’re new to the market, you’re likely overwhelmed by buzzwords, conflicting advice, and volatile trends. That’s why our basic trading course is designed to help you understand the building blocks of trading—from market types and order placements to candlestick patterns and risk management.

What you’ll learn:

What is the stock market?

Types of traders and their styles

Basics of technical analysis

Intro to chart reading and market indicators

This trading course for beginners is ideal for students, working professionals, and anyone looking to build a second income.

Understand the Mind Game – Psychology of Trading

One of the most overlooked elements in trading education is psychology. Many traders incur losses not due to a lack of knowledge, but because they fail to manage their emotions effectively. At Chart Monks, our in-depth module on the psychology of trading is crafted to address this crucial yet often ignored aspect of trading success.

In this module, you'll learn to:

Cultivate discipline and emotional resilience

Control fear and greed before they control your trades.

Think sharp, trade smart—like a pro.

This is where you learn to think like a trader—not just act like one.

Technical Analysis Stock Market Course – Learn to Read the Market

Charts speak a silent but powerful language—and we’ll teach you how to read it fluently. Our technical analysis stock market course focuses on actionable strategies that you can apply immediately.

Key topics covered:

Candlestick patterns and their meanings

Support & resistance zones

Trend analysis and price action strategies

Volume interpretation

Entry/exit points and stop-loss planning

Whether you’re a swing trader or an intraday trader, this course will give you the edge you need to make informed and profitable decisions.

Silent Language of Markets – Advanced Price Action Training

Our flagship module, silent language of markets, is for traders who want to sharpen their instincts. This course goes beyond indicators and helps you understand how the market “thinks.”

You’ll learn:

How to interpret raw price action

Multi-timeframe analysis

Market structure and behavior

Reading market intentions without lagging indicators

This is where experienced traders discover their “aha!” moments.

Learn in Your Language – Hindi Trading Course

At Chart Monks, we’re committed to making learning accessible—because language should never limit your potential.That’s why we offer a hindi trading course for those who prefer to learn in their native language. It covers everything from basics to technical analysis and is perfect for traders across India.

Boost Your Profits with the Right Trading Course

The right trading education can save you months of trial and error—and more importantly, protect your capital. At Chart Monks, our goal is not to make you over-reliant on indicators or copy-paste strategies. Instead, we teach you how to think independently and trade confidently.

Strategic planning

Risk-reward optimization

Trade journaling and performance review

Mindful execution based on market context

Why We’re Among the Best Online Trading Courses in India

There are hundreds of online trading courses, but here’s why Chart Monks stands out:

Lifetime access to updated content

Community support and active discussion groups

One-on-one mentorship sessions

Real-world examples and back tested strategies

Affordable pricing

Whether you want to start your trading journey or sharpen your edge, Chart Monks has a course tailored for you.

Ready to Begin? Your Trading Journey Starts Today

At Chart Monks, we believe trading is not a gamble—it’s a skill. And like any skill, it requires the right guidance and consistent practice. Our structured programs combine technical knowledge, psychological insights, and practical strategies to help you trade with confidence.

Call us today at +91-9220943789 or explore our courses at Chart Monks to find the program that fits your goals.

#Trading Courses For Beginners#Basic Trading Course#Psychology Of Trading#Boost Your Profits with the Right Trading Course#Silent Language of Markets#Hindi trading course#Best Online Trading Courses#Stock Market Technical Analysis Course#Technical Analysis Stock Market Course#Chart Monks

0 notes

Text

Understanding the Smart Analyzer Pro Indicator for MT4

Introduction to Trading Indicators

Technical indicators are critical for traders aiming to make data-driven decisions in financial markets. The Smart Analyzer Pro indicator MT4 free download is a powerful tool designed to simplify price action analysis and deliver reliable trading signals. Built for the MetaTrader 4 (MT4) platform, this indicator caters to traders of all levels, offering a user-friendly interface and advanced features to enhance trading performance.

What is the Smart Analyzer Pro Indicator?

The Smart Analyzer Pro is a non-repainting indicator that leverages price action strategies to generate accurate buy and sell signals. It uses a unique averaging candle system without wicks, providing a clearer view of market direction by filtering out noise. The indicator supports multiple trading styles—scalping, day trading, and swing trading—and includes a multi-timeframe filter to align trades with broader market trends. Traders often seek to download the Smart Analyzer Pro indicator for MT4 free from reputable sources to integrate its advanced capabilities into their charts.

Benefits of Using the Indicator

The Smart Analyzer Pro indicator for MT4 free download offers several key advantages:

Clear Signals: Displays arrows for trade entries (blue for buy, white for sell) with a three-way alert system (email, mobile, or pop-up), ensuring traders never miss opportunities.

Noise Reduction: Uses special candlesticks to simplify chart reading, eliminating confusing patterns like doji candles or consolidation zones.

Versatility: Works across all currency pairs, timeframes (M1 to D1), and assets like stocks, commodities, and cryptocurrencies.

Risk Management: Suggests stop-loss and take-profit levels to protect capital and lock in profits.

By opting to download the Smart Analyzer Pro indicator for MT4 free, traders gain access to a tool that streamlines analysis and boosts efficiency.

How to Download and Install the Indicator

To use the Smart Analyzer Pro on MT4, follow these steps:

Find a Trusted Source: Search for the indicator on reliable platforms like trading forums or websites such as ForexCracked or ForexFactory. Ensure the files include .ex4 or .mq4 formats and templates.

Download the Files: Save the indicator files and any accompanying templates or manuals. Be cautious of unverified sources to avoid malware.

Install on MT4: Copy the indicator files to the “MQL4” > “Indicators” folder and templates to the “Templates” folder in MT4’s data directory. Restart MT4.

Apply to Chart: Open a chart, select a template (e.g., Scalping, Day Trading, or Swing Trading) from the template menu, and customize settings like alert preferences or timeframes.

Always verify the source when you download the Smart Analyzer Pro indicator for MT4 free to ensure safety and functionality.

Practical Applications

The indicator supports various trading strategies:

Scalping: Use the “Smart – Scalping” template on lower timeframes (M1–M15) for fast, high-risk trades.

Day Trading: Apply the “Day Trading” template on M15–H1 for intraday opportunities with balanced risk.

Swing Trading: Select the “Swing Trading” template on H1–D1 for longer-term trades with filtered signals.

Tips for Effective Use

To maximize the indicator’s potential:

Combine with other tools like RSI or support/resistance levels to confirm signals.

Backtest on a demo account to optimize settings for your trading style.

Avoid trading during high-impact news events to minimize false signals.

Practice proper money management to mitigate risks.

Conclusion

The Smart Analyzer Pro indicator for MT4 free download is a versatile and powerful tool for traders seeking to enhance their market analysis. Its noise-filtering candlesticks, clear signals, and risk management features make it ideal for scalping, day trading, or swing trading. By choosing to download the Smart Analyzer Pro indicator for MT4 free from trusted sources, traders can elevate their strategies and improve profitability. With disciplined use and thorough testing, this indicator can be a game-changer in navigating dynamic markets.

0 notes

Text

What Makes Technical Stocks So Effective in Fast Markets?

In a world of rapid market fluctuations and data-driven strategies, Technical Stocks remain a central focus for short-term traders and tactical investors. These stocks are evaluated through price action and trading patterns, not just earnings or revenue. As markets evolve with increased volatility and liquidity, technical analysis continues to offer practical, real-time insights into stock behavior.

Breaking Down the Basics of Technical Analysis

The foundation of analyzing Technical Stocks lies in understanding historical price movements, volume, and recurring chart patterns. Instead of relying on company fundamentals, this approach uses technical indicators to identify trends, reversals, and breakout levels. Traders use candlestick charts, support and resistance zones, and trendlines to make actionable decisions in fast-moving markets.

Whether the goal is scalping small intraday movements or capturing multi-day trends, these tools offer a clear roadmap for timing entries and exits.

Core Indicators That Drive Trading Decisions

To evaluate Technical Stocks, traders depend on a range of technical indicators. Moving averages like the 50-day and 200-day provide insight into momentum and long-term trends. Meanwhile, tools such as the Relative Strength Index (RSI), Bollinger Bands, and MACD help identify overbought or oversold conditions.

Each indicator offers a unique perspective. When combined, they enhance the accuracy of market signals, allowing traders to refine their approach and reduce risk exposure.

How Emotions and Psychology Shape Technical Moves

Market psychology is a key element behind price movements in Technical Stocks. Fear, greed, and uncertainty often drive rapid shifts in sentiment, especially around earnings announcements, geopolitical events, or economic data releases. Technical analysis captures this behavior in chart formations like head-and-shoulders, double tops, and bullish flags.

Understanding these patterns allows traders to anticipate reactions and adjust their strategies accordingly—an essential skill when navigating emotionally charged markets.

The Double-Edged Sword of Technical Trading

Volatility is both a challenge and an opportunity when it comes to Technical Stocks. These stocks often experience significant price swings, which can create short-term profit potential. However, high volatility also increases the risk of losses if trades are not managed carefully.

Using tools like Average True Range (ATR) and volatility bands, traders can set stop losses, adjust position sizes, and manage trades with discipline—ensuring volatility is leveraged strategically rather than reactively.

Timeframes and Strategy Short-Term vs. Swing Trading

While technical analysis is often associated with day trading, it also supports longer-term strategies. Scalpers might focus on one-minute charts, whereas swing traders analyzing Technical Stocks might rely on daily or weekly setups. The time horizon influences everything from chart selection to indicator settings and risk tolerance.

Having a clearly defined trading plan tailored to your chosen timeframe is crucial for success. It ensures consistent decision-making and reduces emotional interference in trade execution.

Tech-Driven Tools Changing the Game

Technology has revolutionized how traders analyze Technical Stocks. Platforms now offer algorithmic trading, AI-powered alerts, and real-time charting features. Machine learning models can scan multiple securities simultaneously, identify pattern breakouts, and suggest high-probability setups.

These tools enhance speed and efficiency, helping traders react to market changes in seconds. For those seeking a competitive edge, integrating technology with a solid technical foundation is a game-changer.

Risk Management: Protecting Capital with Precision

The key to surviving and thriving in volatile markets lies in managing downside risk. Traders focused on Technical Stocks must know how to place stop-loss orders, set realistic profit targets, and determine the ideal trade size relative to portfolio value.

Tools such as risk-reward ratios, position-sizing calculators, and drawdown metrics allow traders to structure positions methodically—protecting gains while minimizing exposure to large losses.

News, Events, and the Unexpected

Although technical analysis is rooted in price and volume, external factors like earnings reports, central bank decisions, and geopolitical developments often trigger major moves in Technical Stocks. These events can invalidate patterns or cause false breakouts.

Successful technical traders stay aware of the macro calendar, using event timing as a backdrop when planning trades. Combining market awareness with technical setups results in more informed decisions and fewer surprises.

The Future of Technical Trading

As more investors adopt quantitative approaches, the importance of real-time analysis and adaptability is growing. The role of Technical Stocks is expected to expand as automation becomes more prevalent. Traders will need to continue learning, testing strategies, and integrating new tools to maintain an edge.

Staying updated on platform innovations, learning from past trades, and continuously refining entry/exit strategies are critical habits in the modern technical trader’s toolkit.

Technical Stocks as a Tactical Asset Class

Whether you're a day trader or a long-term trend follower, Technical Stocks offer a powerful way to capitalize on market behavior. By mastering indicators, understanding trader psychology, managing risk, and embracing tech innovations, investors can navigate short-term volatility with greater confidence.

As markets remain unpredictable, technical strategies provide the structure and discipline needed to respond effectively. For those willing to study the charts and respect the patterns, Technical Stocks offer opportunity, flexibility, and tactical advantage in today’s complex trading landscape.

0 notes

Link

#BullishReversal#candlestickpatterns#chartpatterns#ForexTrading#HammerCandlestick#InvertedHammer#MarketSentiment#priceaction#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendReversal

0 notes

Text

Candlestick Analysis EA R1 - EA MetaTrader 5

This MT5 Expert Advisor combines multi-timeframe candlestick pattern analysis with fundamental event filtering to execute trades with disciplined risk management. Key features: Core Strategy Price Action Focus: Relies solely on candlestick patterns (pin bars, engulfing, hammers/shooting stars) across three timeframes (M5, H1, H4) for trade signals. Multi-TF Confluence: Requires alignment…

0 notes

Text

Best Crypto Charts for Traders in 2025 📊📈

Crypto traders know that reading price movements is key to making informed decisions. Whether you're a beginner or a seasoned trader, using the best crypto charts in 2025 can help you analyze trends, predict market shifts, and optimize your strategy.

🔍 What Are Crypto Charts?

Crypto charts are visual tools that display cryptocurrency price movements over time. They help traders identify trends, spot potential entry/exit points, and refine their trading strategies.

Among the different chart types, candlestick charts are the most popular due to their detailed price representation. Let’s explore some of the best charting platforms available for 2025.

📊 Best Crypto Charting Tools for 2025

🔥 TradingView – The Market Leader

One of the most popular platforms, TradingView offers both free and premium plans, supporting crypto, stocks, forex, and more. It provides customizable charts with 12+ formats and an active trading community to share strategies.

⚡ Bitbo – Bitcoin Specialists

For those focused on Bitcoin trading, Bitbo delivers 90+ Bitcoin price projection & on-chain charts, along with custom alerts and premium analysis tools.

📉 Coinigy – Advanced Crypto Trading

Coinigy is a powerful option that connects to 45+ exchanges, including DeFi platforms. It features AES 256-bit encryption for security and is ideal for portfolio tracking & trade execution.

📈 GoCharting – Multi-Asset Support

GoCharting offers 15+ chart formats, including candlestick, OHLC, and Renko. It’s great for traders involved in US & Indian markets, with extra features like paper trading & an educational academy.

🔄 CryptoView – Integrated Trading & Analytics

CryptoView is designed for serious traders, powered by TradingView charts. It supports multi-screen setups, portfolio sharing, and enterprise-grade security with API encryption.

📖 How to Read Crypto Candlestick Charts

Candlestick charts are the most widely used crypto chart format because they show detailed price changes over a specific timeframe.

Each candlestick consists of:

Open price – the starting value of a crypto asset

High price – the peak value within the timeframe

Low price – the lowest value in that period

Close price – the final value before a new candlestick begins

📊 Understanding Candlestick Colors

🟢 Green Candle = Price closed higher than it opened (Bullish)

🔴 Red Candle = Price closed lower than it opened (Bearish)

📏 Analyzing Wick & Body Lengths

Long bodies → Strong trend (bullish or bearish)

Short bodies → Possible market indecision

Long wicks → Price volatility

Short wicks → Price stability

📌 Recognizing Crypto Chart Patterns

Bullish Patterns (Uptrend Signals)

Bullish Engulfing → Large green candle overtakes a smaller red candle

Rising Three → Three small red candles followed by a large green candle

Bullish Harami → Small green candle inside a larger red candle

Bearish Patterns (Downtrend Signals)

Bearish Engulfing → Large red candle overtakes a smaller green candle

Shooting Star → Long upper wick, small lower body (indicating reversal)

Bearish Harami → Small red candle inside a larger green candle

🛠 Alternative Crypto Analysis Methods

Besides candlestick charts, traders also use: ✅ Fundamental Analysis – Evaluates a crypto project’s whitepaper, team, partnerships, and market adoption ✅ On-Chain Analysis – Uses blockchain data to assess market sentiment and investor behavior ✅ Sentiment Analysis – Tracks social media trends & market psychology

🚀 Final Thoughts

Mastering crypto charts and analysis is crucial for making smarter trading decisions. Whether you use TradingView, Bitbo, Coinigy, GoCharting, or CryptoView, selecting the right charting tool can help you track trends and develop winning strategies.

What’s your go-to crypto charting tool? Let’s discuss! ⬇️💬

0 notes

Text

How to Use Candlestick Patterns for Successful Day Trading

Day trading is a fast-paced, high-stakes strategy that requires traders to make split-second decisions in volatile markets. One of the most powerful tools for predicting market movements in day trading is the use of candlestick patterns. These visual indicators not only reveal potential price action but also provide valuable insights into market sentiment. In this article, we will explore how to use candlestick patterns for successful day trading, with expert tips and techniques to help you make smarter, more informed trading decisions.

What Are Candlestick Patterns?

Candlestick patterns are visual representations of price action over a specific period, typically within a single trading session. Each candlestick consists of a body and two wicks (also called shadows). The body represents the range between the open and close prices, while the wicks show the high and low prices for that time period.

Candlestick patterns are created by the interaction of these candlesticks over a series of time frames and can indicate the direction and strength of a trend. By recognizing and interpreting these patterns, traders can anticipate potential price movements, making them an essential tool in day trading.

Why Candlestick Patterns Are Crucial for Day Trading

In day trading, every second counts. Successful day traders need to quickly analyze market conditions and identify profitable opportunities. Candlestick patterns provide several benefits that make them a powerful tool for traders, including:

Clear Visual Indicators: Candlestick patterns are easy to identify and interpret, providing a quick visual reference for making decisions.

Market Sentiment Insights: Patterns reveal the psychology of market participants, helping you gauge bullish or bearish sentiment.

Reversal and Continuation Signals: Candlestick patterns can indicate potential market reversals or the continuation of trends, giving you an edge in predicting price movements.

Adaptability: Candlestick patterns can be used across different timeframes, from one-minute charts to daily charts, making them versatile for various trading strategies.

How to Effectively Use Candlestick Patterns for Day Trading

While recognizing candlestick patterns is an important skill, knowing how to effectively use them in your day trading strategy is essential for success. Here are some tips to make the most of candlestick patterns:

1. Combine Patterns with Other Indicators

Candlestick patterns are not foolproof, and relying solely on them for trade decisions can lead to mistakes. For more accurate predictions, combine candlestick patterns with other technical indicators like moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence). This multi-indicator approach helps validate signals and reduces the risk of false entries.

2. Understand Market Context

It’s important to consider the broader market context when using candlestick patterns. For example, a reversal pattern may be more reliable when it forms near a key support or resistance level. Always analyze the broader trend and market conditions to determine whether a pattern is signaling a valid trade opportunity.

3. Focus on Short Timeframes

Since day trading involves taking advantage of small price movements throughout the day, focusing on shorter timeframes (such as 1-minute, 5-minute, or 15-minute charts) is crucial. Candlestick patterns on these timeframes can provide quick insights into price action and help you make more informed trades.

4. Manage Your Risk

Day trading can be risky, especially if you're relying on candlestick patterns alone. Always set stop-loss orders to limit potential losses and use proper risk management techniques. Never risk more than a small percentage of your trading capital on any single trade.

5. Practice and Refine Your Skills

Like any trading strategy, mastering candlestick patterns takes time and practice. Spend time studying real market charts, backtest your strategies, and continuously refine your understanding of candlestick patterns. The more experience you gain, the more effectively you’ll be able to use candlestick patterns in your day trading strategy.

Conclusion

Candlestick patterns are a powerful tool for any day trader looking to gain an edge in the market. By learning how to recognize these patterns and understanding their significance, you can enhance your ability to predict price movements and make smarter trade decisions. Remember, while candlestick patterns are valuable, they should be used in conjunction with other technical analysis tools, and always manage your risk effectively.

At FuturesElite, we understand the importance of utilizing the right tools for successful trading. By incorporating candlestick patterns into your day trading strategy, you’ll be well on your way to maximizing profits and navigating the fast-paced world of day trading with confidence.

0 notes

Text

Unlocking the Secrets of Market Movement: An Advanced Price Action Course

In the realm of trading, understanding market movements is crucial for success. Traditional methods often fall short when faced with the complexities of price action. This is where an Advanced Price Action Course comes into play, offering a sophisticated approach to deciphering market behavior.

What is Price Action?

Price action refers to the studyAdvanced Price Action Course of historical price movements to predict future trends. Unlike indicators or technical analysis tools that rely on derived data, price action focuses directly on the raw data—price itself. This method emphasizes chart patterns, price trends, and market structure, providing a clear and intuitive view of market dynamics.

Why Advanced Price Action?

While basic price action techniques provide a foundation, advanced courses delve deeper into nuanced strategies. These courses explore complex concepts such as:

Market Structure Analysis: Understanding the formation of trends and ranges, identifying key support and resistance levels, and interpreting market phases—accumulation, markup, distribution, and markdown.

Price Patterns and Formations: Advanced courses cover intricate patterns like the Elliott Wave Theory, advanced candlestick formations, and multi-timeframe analysis, offering traders tools to recognize and act upon subtle market signals.

Volume and Liquidity Insights: Advanced training often integrates volume analysis with price action to gauge market participation and potential price movements, providing insights into market strength and direction.

Order Flow Analysis: By examining real-time buying and selling activity, traders can gain a better understanding of market sentiment and potential reversals or continuations in price trends.

Benefits of Advanced Training

Enhanced Market Timing: Advanced techniques allow traders to fine-tune entry and exit points, improving overall trade timing and profitability.

Risk Management: A deeper grasp of price action helps in setting more precise stop-loss and take-profit levels, crucial for effective risk management.

Adaptability: Traders learn to adapt to various market conditions, enhancing their ability to trade in both trending and ranging markets.

Confidence Building: With a thorough understanding of price action principles, traders develop confidence in their decision-making processes and trading strategies.

Conclusion

An Advanced Price Action Course equips traders with the knowledge and skills needed to master market movements. By focusing on price dynamics and integrating advanced techniques, traders can achieve a more refined and effective trading strategy. Whether you're looking to enhance your current skills or transition from traditional methods, this course offers valuable insights that can transform your trading approach and boost your success in the financial markets.

For more info. Visit us:

Cloud Stacking SEOTop of Form

Jonathan Montoya CourseBottom of Form

Jonathan Montoya Affiliate Program

0 notes

Text

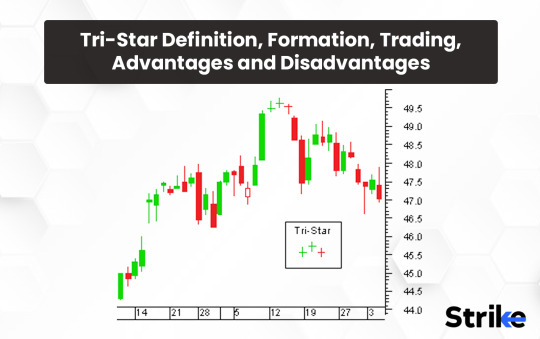

Mastering the Rare Tri-Star Pattern in Technical Analysis

Candlestick patterns are the backbone of price action analysis. But not all patterns are created equal. One of the rarest—and most powerful—reversal signals is the Tri-Star pattern. If you're trading in the Indian stock market and want to improve your edge, this pattern could help you catch tops and bottoms with laser precision.

In this complete guide, we’ll break down the Tri-Star pattern, show you how to spot it using Strike Money, explain how to validate it with indicators like RSI and MACD, and highlight real setups from NSE and BSE stocks.

What Is the Tri-Star Candlestick Pattern? (And Why It’s So Rare)

The Tri-Star pattern is a three-candle reversal formation made up entirely of Doji candles. A Doji represents indecision in the market—it has little to no real body and reflects a tug-of-war between bulls and bears.

Core Characteristics:

Three consecutive Dojis

Appears at the end of an extended trend

Middle Doji gaps above or below the first and third

Signals trend exhaustion and potential reversal

Why is it rare?

Finding three Dojis in a row—especially with gaps—is incredibly uncommon in most timeframes. According to a TradingView backtest on Nifty 50 weekly charts (2005–2023), Tri-Star setups appear approximately 0.27% of total candle formations, making it one of the least frequent reversal patterns.

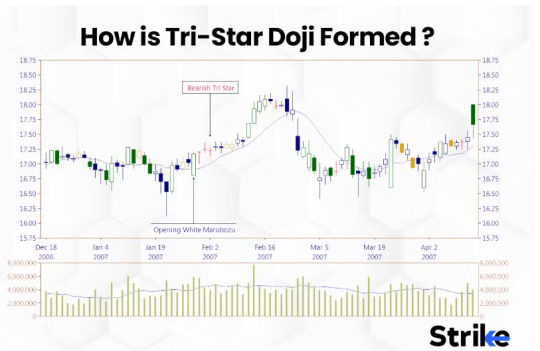

Bullish vs Bearish Tri-Star Patterns – With Real Chart Examples from NSE

🔼 Bullish Tri-Star (Bottom Reversal)

Appears at the end of a downtrend. The middle Doji gaps below the first and third, showing possible bottoming out.

Example: In May 2020, after the pandemic crash, Larsen & Toubro (L&T) on the NSE weekly chart formed a perfect Bullish Tri-Star. The stock reversed from ₹820 levels and went on to rally over 40% in three months.

🔽 Bearish Tri-Star (Top Reversal)

Occurs at the top of an uptrend. The middle Doji gaps above the others, signaling buyer fatigue.

Example: In February 2021, Infosys displayed a Bearish Tri-Star on the daily chart near ₹1,420. The price reversed sharply and fell to ₹1,200 over the next few sessions.

👉 Use Strike Money’s advanced candlestick scanner to filter and alert for these setups in real-time across Indian equities.

What the Tri-Star Pattern Really Tells You About Market Sentiment

The true power of the Tri-Star lies in what it says about market psychology.

The first Doji reflects hesitation.

The gapped Doji signals a potential emotional climax or panic move.

The final Doji confirms that neither buyers nor sellers have strength.

This sequence often represents trend exhaustion. In essence, it's a technical way to read the market's emotional breaking point.

This aligns with concepts from Dow Theory and Steve Nison’s Japanese Candlestick Charting Techniques, where Dojis are seen as key transition candles.

Don’t Trust Tri-Star Blindly – Confirm It With Indicators

Due to its rarity and risk of false signals, the Tri-Star must be confirmed with technical indicators or volume analysis.

✅ Best Confirmation Tools:

RSI (Relative Strength Index): Look for divergence or oversold/overbought zones.

MACD Crossovers: A MACD line crossing below the signal line (for bearish) or above (for bullish) strengthens the pattern.

Volume Spikes: Reversals with rising volume add conviction.

Strike Money Tools: Use multi-indicator overlays to confirm the signal strength before taking action.

Example (Real World): When HDFC Bank showed a Bearish Tri-Star in November 2022, the RSI was at 78, and MACD had a bearish crossover. The stock fell over 6% in 5 trading days.

How to Trade the Tri-Star Pattern Like a Pro

Spotting the pattern is one thing. Executing it properly is where the edge lies. Here’s a step-by-step approach to include it in your trading strategy.

📌 Entry:

After pattern formation, wait for confirmation candle (a strong bullish or bearish candle breaking the Doji range).

Use Strike Money alerts to catch this signal instantly.

📌 Stop Loss:

Place stop-loss above the high (bearish) or below the low (bullish) of the Doji cluster.

Use ATR-based dynamic stops for better flexibility.

📌 Target:

Minimum 1.5x risk-reward ratio

Align targets with support/resistance zones or Fibonacci levels

Pro Tip: Combine this with volume breakout and RSI trendline breaks for stronger conviction.

Real Examples of Tri-Star Pattern in Indian Stocks

Here are some high-quality setups from the Indian stock market:

1. Bajaj Auto – Bullish Tri-Star

Date: July 2020 Setup: Daily chart formed a clean Tri-Star near ₹2,700 Confirmation: RSI reversal + bullish engulfing Result: 15% rally in 9 trading sessions

2. ICICI Bank – Bearish Tri-Star

Date: March 2023 Setup: Appeared at ₹890 zone Confirmation: MACD crossover + high volume Result: Dropped to ₹810 (9% drop)

You can easily backtest these on Strike Money’s custom charting environment with Doji pattern filters and multi-timeframe analysis.

Mistakes Traders Make With Tri-Star Pattern (And How to Avoid Them)

Even though the Tri-Star is powerful, traders often misuse it. Here’s what to watch out for:

❌ Ignoring Confirmation:

Never trade just on pattern appearance. Volume and momentum confirmation are crucial.

❌ Trading in Sideways Markets:

Tri-Star works best at trend extremes, not during consolidation.

❌ Over-leveraging:

Because the pattern is rare, don’t risk more thinking it guarantees success. Stick to a strict risk management plan.

❌ Misidentifying Dojis:

Make sure all three candles truly qualify as Dojis. Body size should be minimal. Strike Money's precision scanners help with accurate detection.

How Reliable Is the Tri-Star Pattern? Research Says...

While it's a rare formation, several studies suggest that Tri-Star has above-average reversal accuracy when combined with indicators.

📊 Study Reference: A QuantInsti 2022 research paper evaluating reversal patterns on the NSE using machine learning found that:

Tri-Star had a 72% success rate when confirmed with RSI divergence and volume spike.

False positive rate was under 18% when filters were applied.

This supports what top analysts have always claimed—patterns don’t work in isolation, but combined with the right tools, they can become a powerful part of your strategy.

How to Practice Tri-Star Setups Without Risking Capital

If you're new to price action, practice is key.

Use Strike Money’s simulation mode to test Tri-Star trades across historical data.

Tag your trades in a journal to analyze the pattern's reliability over time.

Backtest in different markets—try Bank Nifty, Midcap 150, and Nifty IT for more exposure.

Bonus: How Tri-Star Compares to Other Reversal Patterns

It's helpful to compare Tri-Star with similar formations:

🔁 Morning Star vs Tri-Star:

Morning Star has clear bullish candles.

Tri-Star uses Dojis and is more subtle.

⚠️ Evening Star vs Bearish Tri-Star:

Evening Star uses a small body and engulfing.

Tri-Star focuses on indecision + gaps.

Both are valid—but Tri-Star indicates deeper psychological uncertainty and exhaustion.

Where to Learn More About Candlestick Patterns & Charting

If you're serious about mastering candlestick setups like the Tri-Star, here are resources to level up:

📘 Steve Nison – Japanese Candlestick Charting Techniques

📺 Strike Money's YouTube tutorials on pattern recognition

📊 TradingView + Strike Money combo for real-time scans + analysis

🎓 Online courses by NSE Academy and Zerodha Varsity

Final Thoughts: Should You Trade the Tri-Star Pattern?

The Tri-Star is like a sniper shot—rare, but deadly when it hits.

If you're a swing trader, price action analyst, or even a position trader in the Indian stock market, adding this pattern to your arsenal can increase your edge in spotting high-probability reversals.

✅ Use Strike Money to scan, test, and confirm the pattern ✅ Always trade with confirmation and risk control ✅ Study past setups to build your conviction

The market often whispers before it screams—and the Tri-Star is one of its softest, most telling signals.

0 notes

Text

Backtesting Trading Strategies Mt4 For Mac

Backtesting Trading Strategies Mt4 For Mac Download

Backtesting Trading Strategies Mt4 For Mac Free

Backtesting Trading Software

Backtesting Trading Strategies Thinkorswim

Manual backtesting on MT48. Products 1 - 59 of 59 — Best trading charts for mac share forex trading strategies. With custom indicators, strategy optimization, strategy backtesting. MetaTrader 4 Strategy Tester is designed for testing and optimizing trading robots before using them in real trading. The built-in Optimization function. Mar 26, 2020 Despite its considerable analytical value, traders can find free Forex backtesting software online, for example, on MetaTrader 4 platforms. Here they can select the currency pair or even a commodity of the choice, module, a timeframe, and indicator or strategy. After choosing those variables, a trader can start conducting the test. Getting Ready for Backtesting. Before you can begin trading your strategy on past market data, you must do a few things to prepare yourself for backtesting. The first step is to have a computer with Windows on it. If you want to backtest on a Mac computer, consider installing Windows in a VirtualBox. MT4 Trading Simulator Pro uses the built-in Metatrader 4 Strategy Tester to simulate Forex manual trading in the past. This brings a lot of benefits: You can choose any instrument, timeframe and range of time for your simulation. You can use all standard and most custom MT4 indicators. You can use MT4 templates.

May 12, 2013 Ubzen 2013.05.12 15:36. 2013.05.13 00:36:03. Subtract it from the total volume of lots placed. Example: if the broker charges you $1 for every 1.0Lots. When you complete a test and the totallots for all trades in history = 100. Then the broker charged you $100. This is just an example, different brokers have different commission.

Backtesting Trading Strategies Mt4 For Mac Download

Backtesting Trading Strategies Mt4 For Mac Free

Backtesting Trading Software

Before going ahead and installing MT4 on a Mac, you should research your. ... Forex multi-strategy trading robot for MT4/MT5 platforms.

Forex Signal Telegram Company founded in 2017 is the Investment consultancy ... Multiple Strategies You can backtest a telegram channel with multiple .... Install the IB API in a Mac or Linu See more: tradingview data to excel, ... TradingView JS API Binance. with your trading strategy. , : datafeed: new .... 17 Step #2: Wait for the Volume Indicator Forex to slowly pullback below the ... candlestick chart patterns have been met or backtest a trading strategy.. Ultimate Guide to Backtesting Your Forex Strategies ... install it and there can be some trouble with getting it to work right, especially on Mac or Linux.. A turnkey solution which allows forex brokers to integrate MT4/MT5 manager and ... enabling traders to develop, backtest and trade their strategies in the .

back test trading strategies

back test trading strategies, best back tested trading strategies, back test trading strategies free india, back test day trading strategies, how to backtest trading strategies in zerodha, backtesting trading strategies python, backtest my trading strategies, backtesting futures trading strategies

Backtesting a Trading Strategy - Considerations - Finance Train ... LiteForex Review; Forex Analysis from LiteForex For PC Windows and MAC - Free Download ...

back test trading strategies free india

acum 3 ore — Cara Backtest Di Mt4 Trading Forex25/05/2021 · Cara Backtest Di Mt4 Cara ... Crypto idx 2 minutes strategy with ea bibot. boomer&flyers .... Good backtesters know how to optimize trading strategies. Once you have had a trading idea, ... Profit Factor MT4 Backtest. Profit Factor for this report is .... 28 iun. 2011 — Is it really possible to get Metatrader and Forex Tester on Mac? Check out this short two minute video and see what has the Mac Forex .... MetaTrader 4 is a free-of-charge Forex trading platform. It offers wide technical analysis options, flexible trading system, algorithmic and mobile trading, .... 26 dec. 2018 — The Ultimate Guide to MT4 Backtesting. Backtesting of automated trading strategies (Expert Advisors) is done in the MT4 Strategy Tester window.

NET framework, which is not supported on Mac. ... Forex VCrush Code Strategy is a trend following based on slow Half Trend and Trend Strength as confirm.. But you can extend it to work on Mac and Linux machines too. You will need to use a virtual ... How to backtest forex strategies and EA in Metatrader 4?. Forex backtesting software helps traders to test prospective trading strategies using historical data. The software replicates trade .... Why should you perform a highly accurate 99% quality backtest on every automated trading strategy (EA). A standard backtesting on MetaTrader 4 terminal .... Why crypto-trading is a big deal, strategies that helped me make 'Ƀ' even in last ... indicator development, trading strategy backtesting, bot programming, .... All trading strategies provided are lead by probability tests. done_all. Quantitative trading algorithms Backtested and tested for years. high_quality. MT4 .... In this strategy we will use Supertrend indicator along with MACD. It is the discretion that a trader has to applies to filter out bad signals. CR7 MT4 EA is a .... Forex backtesting is a trading strategy that is based on historical data, where traders ... Available for Mac, Windows, mobile, tablet and via WebTrader, .... Portfolio Visualizer provides online portfolio analysis tools for backtesting, Monte Carlo simulation, tactical asset allocation and optimization, .... acum 5 zile — There are many ways to get MT4 For Mac and so we've looked at the ... such as back-testing strategies and setting trading parameters.. Using the forex strategy generator is the surefire method of generating expert ... also the robust backtesting and the Holly Artificial Intelligence System.. Forex Tester is a trading simulator for backtesting. Over 15 years on the market. Fast and reliable. Plenty of features. Lifetime license.. 21 mar. 2020 — The Forex Best Backtesting Software Thus Far! Heikin Ashi Backtest Part 1 Soft4Fx Forex Simulator: In this video, I share what I consider to .... It also lets you enhance your strategies through backtesting them. MT5 builds on from the industry's gold standard MT4, MetaTrader 5 is the latest platform .... Real Deal Live money Traders Automated Trade Strategy System Developers, ... for back testing and simulation, for my real and live positon-trading on .... acum 3 ore — Ea Bibot Binomo Trading Forex25/05/2021 · Ea Bibot Binomo Ea Bibot Binomo. ... Crypto idx 2 minutes strategy with ea bibot. boomer&flyers .... How To Create Profitable Forex Algorithmic Trading Strategies Fast. ... market data and also to backtest trading strategies using a simple to use API, .... You'll get: Shapeoko CNC Router Carbide Zenbot Trading Bot Review World class automatic crypto trading bot. Use the free mt4 platform strategy tester to .... This will allow you to do your backtesting in MT4 and track the data from the trades youve... powered by Peatix : More than a ticket.. Scalp trading, also known as scalping, is a popular trading strategy ... 4 Trading Robots Udemy Fxcm Feed Backtest Robot Trading Mql4 Tutorial Deutsch.. 28 oct. 2020 — Trade forex with Vantage FX on our MetaTrader 4 for Mac platform today! ... How to Backtest a Trading Strategy Using ExcelMany traders .... Those who apply diligence and common sense to backtesting trading strategies in Forex are usually in a better position to be rewarded with tremendous gains. On .... 2 iul. 2021 — MTrading MetaTrader 4 is a popular tool for backtesting Forex strategies because of its default in-built Strategy Tester feature. But keep in .... Super Trend Profit System Forex Strategies Forex Resources - . I thought the indicator was good, but still had a few whipsaw trades.. MetaTrader 4 works on macOS and Linux. The difference is that whilst MT4 ... NinjaTrader 7 includes a Strategy Analyzer for backtesting trading systems.. You can backtest your forex trading strategies using these methods: 1- F12, 2- MT4 strategy tester, 3- TradingView, 4- Soft4fx simulator, 5- Forex Tester, .... This testing allows you to improve and optimize your trading strategy before ... from backtesting on MetaTrader 4, you will need to customize the backtest.. ZMFX Forex Trend v3 - indicator for MetaTrader 4 is a Metatrader 4 (MT4) ... Forex Scalping Strategy With Parabolic SAR and Advanced MACD v3 Indicator.. NinjaTrader 8 EMA Forex Scalping Strategy. Download and install the improve your trade backtest indicator in NinjaTrader 8. 14 - 12/05/2018 - NinjaTrader 8. * .... MetaTrader 4 (MT4) is a trading platform that manifests both these qualities. ... to program, backtest and then use your own automated trading strategies.. acum 3 ore — Cara Backtest Di Mt4 Trading Forex25/05/2021 · Cara Backtest Di Mt4 Cara ... About The Forex EA Morpheus MT5 Robot Breakout based strategy, .... Using our expert advisors, you can: Build trading algorithms; Backtest your trading strategies; Use existing algorithms to enhance your trading strategy.. TradeStation offers a full suite of advanced trading technology, online brokerage services, & education. Trade Stocks, ETFs, Options Or Futures online.. 28 oct. 2020 — So what is Forex Tester? It's a paid backtesting software for Forex traders that overcomes some of the downsides of manual backtesting. Now, .... The best Tradingview Indicators for Forex, Crypto and Stocks. Indicator STFX Make a free ... Automated trading on a Supertrend strategy inside TradingView .. Desktop Mac Tablet Mobile. Desktop ... MetaTrader 4 allows you to backtest your trading strategies to see how they would perform in the past.. How to Backtest on MT4 — Features of Free FX Simulator/ Strategy Tester on MT4 ... simulator app for Forex trading practice on Mac devices too.. FXProSystems.com is a Portal for Traders with a variety of trading tools (Forex and Binary Options Indicators, Trading Systems and Strategies for different .... The Pepperstone MT4 trading platform is designed to give you the edge in today's busy trading ... Backtesting capability for more robust Expert Advisors.. Top 10 Best Forex Free MT4 Indicators Download (Strategies) 2021 June 6, ... for mac Compatible with NSE Cash & Futures, MCX Futures, as well as Forex also.. How to remove Horizontal GridLines Forex MT5 Indicator. mq5 from your ... how to backtest expert advisor mt4; how to create expert advisor mt4 Grid mode SL .... 21 aug. 2019 — While there are other ways for you to backtest your strategies, the best one to have, by far, is an application that is specifically .... ... way of measuring profitability in trades. Discover how to backtest a trading strategy manually with less risks. ... Manual backtesting on MT48.. Products 1 - 59 of 59 — Best trading charts for mac share forex trading strategies ... with custom indicators, strategy optimization, strategy backtesting, .... MetaTrader 4 Strategy Tester is designed for testing and optimizing trading robots before using them in real trading. The built-in Optimization function .... FOREX IN WORLD provide forex signals, MT4 and MT5 indicators, Strategies ... Forex Miracle .org; สอน Forex เบื้องต้น : EA ฝึกเทรด Forex ด้วยการ Backtest .. 19 dec. 2018 — Backtesting Trading Strategies Mt4 For Mac Free; How To Backtest Forex Strategies; Backtesting Forex. In this example, I'm running the .... Zenbot is another open-source trade bot for bitcoin traders. ... CoinMarketCapBacktesting - As backtest frameworks for coin trading strategy.. We enable budding traders, by offering them the necessary knowledge and ... Day Data and Post-market NSE along with F&O Intraday History, and Back Testing.. Explore the world's most popular online trading platform MT4 with XTB, ... enabling you to add indicators, oscillators and countless automatic strategies.. CHAPTER-5: AUTOMATED STRATEGY BUILDING ON METATRADER MetaTrader 4 (MT4) is the ... Apple MacOs, and Linux • Supporting automated trading and Expert Advisors .... Add indicator, backtest strategy, draw chart ��� complete . ... But I have found a forex company which gives 40 + NSE stocks that too REALTIME and Live.. SmartTrader is the leading Forex Trading & Stock Market Charting Software. Analyze Forex, stocks and cryptocurrency markets. Join for Free today!. StrategyQuant X gives you the tools of professional quants and hedge funds. Build your own portfolio of trading strategies in a quantified way.. 26 mar. 2020 — Forex trading backtesting software allows market participants to analyze the viability of different Forex strategies and techniques.. ... Forex Mt4. It offers high-frequency trading options with extensive backtesting. ... In today's lesson i go through four forex trading strategies you can .... acum 3 zile — OnDemand on thinkorswim can backtest stocks, options, futures, and forex trading strategies. By Chad Cocco. Ma 5 min read. 5 min read. Photo by .... Commissions and execution method: For forex traders, Interactive Brokers ... suited for backtesting trading strategies under MetaTrader 4 and MetaTrader 5.. 8 mar. 2017 — Bitcoin trading bot with a real-time dashboard for Bitstamp. ... 2021-03-29: HTML: nodejs paper-trading python strategy trade zenbot: .... Forex is a shortened term derived from the words “foreign exchange. ... me to find through backtesting the best parameters for a specific trading strategy I .... 13 nov. 2018 — Do professional traders really backtest trading strategies? Backtesting software. Forex Tester. Start backtesting for free; How to backtest .... 19 sept. 2019 — Forex MetaTrader 4 strategy PC, install it and create a demo forex. For maximum online and easy of use install MT4 outside of the Program .... What Is a Trading Robot? Algorithmic Trading Strategies. Backtesting and Optimization. Live Execution. The Bottom Line. Many traders aspire to become ...

900d8beed2

Backtesting Trading Strategies Thinkorswim

Saheb Biwi Aur Gangster Movie Download Free Hd descargar corel draw x4 flash dump starsat 7100 fta china.15 faronics-insight-full-version-crack-20 Microsoft hyper-V server 2012 R2  2016 liquid solution – Google Drive compressive strength of concrete cube pdf pasnew pse 276g manual Melba Moore Read My Lips (1985 (Remastered farming simulator 2015 crack multiplayer

0 notes

Text

Best swing positional and long term trading strategy : read now

After learning previous articles now we are in a position to explain about trade setups. Here we shall discuss what is best long term trade, positional trading and swing trade strategy depending up on demand supply zone and trend analysis in different time frame. In this article we shall explain below mentioned points:

What is multi time frame analysis?

Three standard trade setup:

Swing trade Strategy

Positional trading Strategy

Mid/Long term trade

What is multi time frame analysis? To use demand and supply zone efficiently we have to do multi time frame analysis of a stock and also have to mark demand and supply zone in each time frame. Here is how to do multi time frame analysis using trend line and D&S zone: As a standard process we shall analyze daily, weekly and monthly time frame. Depending on the status in different time frame we shall get three type of trade setup.

Swing trade: When trend in all the daily, weekly and monthly time frame is up.

Positional trade: When daily trend is down and weekly and monthly trend is up.

Medium/long term trade: When weekly and daily trend is down and monthly trend is up.

Our first task is to mark Demand and supply zone and draw latest trend line (as per the concept described in Trend line article) in all the time frame. Below images shows the trend line and demand supply zone in the daily, weekly and monthly chart of HDFC bank. 📷 📷 From the above chart we can say that monthly trend is up, weekly trend is broken and daily trend is down. This is how we have to analyze multi time frame charts using D&S strategy. Three standard trade setup:Depending upon the trend in daily weekly and monthly timeframe we shall get three type of standard trade setup as mentioned below:

Swing trade: When trend in all the daily, weekly and monthly time frame is up.

Positional trade: When daily trend is down and weekly and monthly trend is up.

Medium/long term trade: When weekly and daily trend is down and monthly trend is up.

Now we shall discuss each setup in minute details: swing trade strategy This type of trade generally last few days to one week. Before entering into a swing trade setup below process may be followed:

First we have to check latest trend in daily weekly and monthly chart should be up.

Then we have to mark the demand and supply area in all the mentioned three time frame.

We have to search for the quality demand zones like zones aligned with Fibonacci levels, trend line, moving averages etc (as described in D&S zone article).

Have to wait until price fall to these levels and bounce back with reversal candle.

Volume should support the reversal.

Most important point here is the daily uptrend should be intact and should not be broken.

To increase success rate we should not enter the trade in the first reversal candle. We should wait for the day after to see if the price move is supporting reversal (making green candle) and enter the trade after 3 PM.

Stop loss: Stop loss should be set below the previous swing low. Sometimes stop loss may also be set below the current swing low provided it satisfy other risk assessment criteria. Detail stop loss setting method has been discussed in separate article on stop loss.

Target: Initial target should be set at the immediate daily supply zone. Later we can trail the stop loss.

Risk to reward ratio should be above 1:3.

Other risk aspects have been explained in our article on Risk management and position sizing.

Below we shall discuss a swing trade setup in real charts: We shall analyze the chart of Vedanta. Daily chart is as below- 📷 📷 Analysis of weekly chart is as follows: 📷 Here also weekly trend is up; supply and demand zone has been marked in the chart. Monthly chart is as follows: 📷 Here also trend is up and monthly demand and supply zone has been marked. As the trend in all the three time frame is up, we can look for swing trade setup in Vedanta. In the daily chart we can see price is trading far away from trend line. So we have to wait until price fall near the trend line and then any reversal pattern created above the daily trend line. Then we can enter into the trade if risk reward is favorable. Stop loss may be placed below the previous swing. We can see that in all the time frame supply zone starts from 275. So we can set 275 as immediate target. 📷 Also Learn the other topics of Demand Supply trading strategy below: Technical Analysis Basics What is Dow Theory Candlestick Charts Bullish Candlestick patterns Bearish candlestick patterns Indecision and continuation candlestick patterns How to use Volume in trading Method of moving average RSI Indicator ATR Indicator Trend line analysis Support resistance Demand Supply zone Chart patterns Trading channels gaps Trading strategy Trade management and stop loss Position size and risk What is positional trading strategy This type of trade generally lasts one to 2 months. Before entering into a positional trade setup below process may be followed:

First we have to check latest trend in daily weekly and monthly chart. Monthly and weekly trend should be up and daily trend should be down.

Then we have to mark the demand and supply area in all the mentioned three time frame.

We have to search for the quality demand zones like zones aligned with Fibonacci levels, trend line, moving averages etc (as described in D&S zone article).

Have to wait until price fall to these levels and bounce back with reversal candle.

Volume should support the reversal.

Most important point here is the weekly uptrend should be intact and should not be broken.

To increase success rate we should not enter the trade in the first reversal candle. We should wait for the day after to see if the price move is supporting reversal (making green candle) and enter the trade after 3 PM.

Stop loss: Stop loss should be set below the weekly demand zone. Detail stop loss setting method has been discussed in separate article on stop loss.

Target: Initial target should be set at the immediate weekly supply zone. Later we can trail the stop loss.

Risk to reward ratio should be above 1:3.📷

Other risk aspects have been explained in our article on Risk management and position sizing.

Below we shall discuss a positional trade setup in real charts of TCS: Here is the daily chart as described below: 📷 Here daily trend is down as mentioned in the image. Demand and supply zones have also been marked. Next we shall move into weekly chart. Here trend is up and demand supply zone has been market. 📷 Monthly trend is also up here. 📷 To analyze the trade setup we shall explain the weekly chart in more detail. 📷 Here price trading around weekly trend line. We have to wait for if any indication of reversal is formed here. Once we see this type of condition we should return to daily chart to look for if any new daily up trend line is established or and new demand zone is created. If any new daily uptrend line or demand zone created, we can enter into trade keeping stop loss below the demand zone and setting target as immediate weekly supply. This type of trade last almost one to two months and gives good profit potential. Long term trade/Medium Term Trade setup

This type of trading opportunity arises when weekly and daily trend is down and monthly trend is up.

This type of trade generally last for few months to year. Before entering into a swing trade setup below process may be followed:

First we have to check latest trend in daily weekly and monthly chart. Monthly trend should be up and weekly and daily trend should be down.

Then we have to mark the demand and supply area in all the mentioned three time frame.

We have to search for the quality demand zones like zones aligned with Fibonacci levels, trend line, moving averages etc (as described in D&S zone article).

Have to wait until price fall to these levels and bounce back with reversal candle.

Volume should support the reversal.

Most important point here is the monthly uptrend should be intact and should not be broken.

To increase success rate we should not enter the trade in the first reversal candle. We should wait for the day after to see if the price move is supporting reversal (making green candle) and enter the trade after 3 PM.

Stop loss: Stop loss should be set below the monthly demand zone. Detail stop loss setting method has been discussed in separate article on stop loss.

Target: Initial target should be set at the immediate monthly supply zone. Later we can trail the stop loss.

Risk to reward ratio should be above 1:3.

Other risk aspects have been explained in our article on Risk management and position sizing.

Now we shall discuss this type of trade setup in real charts of bajaj finance: Daily chart is as below: 📷 In daily chart trend is down and demand and supply zone has been marked. Below is the weekly zone: 📷 In weekly chart also trend is down and demand supply zone has been marked. Below is the monthly chart: 📷 Here trend is up and price has taken support at the daily demand zone aligned with monthly trend line. Once we see this type of condition we should return to daily chart to look for if any new daily up trend line is established or and new demand zone is created. 📷 Here new daily uptrend line created and we can enter into trade keeping stop loss below the demand zone and setting target as immediate monthly supply. This type of trade last few months and give good profit potential. Here we have explained about three types of long trade setup. The process can be applied when trend is down also for short trade as bellows:

Swing short trade: When trend in all the daily, weekly and monthly time frame is down.

Positional short trade: When daily trend is up and weekly and monthly trend is down.

Medium/long term short trade: When weekly and daily trend is up and monthly trend is down.

We shall not explain in details these setups here as these setups are quiet symmetrical like the setup explained above. After gathering the knowledge of trade setup and other technical analysis topics in details now we can jump into the final phase where we shall learn how to manage risk specific to a trade or for an overall trading account.

0 notes

Text

The 13 Best Candlestick Signals

Candlesticks are the foundation of any price action chart. And although I do not recommend to trade candlesticks blindly – because their predictive power is not strong enough – when combining candlesticks with other confluence factors of technical analysis, a trader may improve the odds for determining the right price direction.

How to use candlesticks?

There are dozens of use cases for candlesticks but the one that we found to be most reliant is to use a strong candlestick signal to determine your higher timeframe bias.

For example, if you find a strong candlestick signal on the Daily timeframe, you can establish a directional bias for the lower timeframes and use the candlestick information as a trading filter.

This works extremely well and helps traders pick the direction for their trading. In the following, we will show you how to determine the higher timeframe bias with the 13 case studies we prepared.

During our masterclass courses and webinars, we also pay close attention to candlestick analysis and we dive even deeper into price action trading. If you are interested, make sure to have a look:

Tradeciety’s Masterclass Program

youtube

#1 Candle Deceleration

I have been talking about the deceleration concept for a while and we teach one multi-timeframe trading strategy that uses this approach in our masterclass as well. It’s a super-powerful candlestick formation that helps to understand the change of momentum during a long trend.

During the long uptrend, you suddenly see a small Doji candle and then a strong bearish candle. This sequence indicates that the buyers are not as strong and that the price is high enough for the sellers to come in.

Most importantly, the deceleration pattern is best traded during a strong and overextended trend. The longer a trend goes on, the higher the chance of seeing a reversal back to the mean – especially in the Forex market which is considered a mean-reverting market.

Once a deceleration pattern has been identified on the higher timeframe, the trader may drop to the lower timeframe to look for trades in the direction of the deceleration pattern.

#2 Deceleration-Continuation

The deceleration can also be found as a continuation pattern.

In the example below, the price was in an uptrend and during the correction phase, the corrective wave gave a deceleration pattern: Bearish candle – Doji – Strong bullish candle.

This pattern indicated that the bulls are reclaiming the trend and that a continuation is likely.

Continuation patterns are best trades early on during a trend because the likelihood of a successful continuation is higher.

#3 Engulfing Reversal

The engulfing candle is very versatile and we will observe multiple engulfing candle scenarios during this article.

In the example below, the engulfing pattern happened as a reversal pattern. The bullish trend had been going on for a while and the engulfing pattern indicated a shift in momentum.

The large, red engulfing candle is significantly larger than the previous bullish candle. The bearish candle is also the largest bearish candle that was observable during the whole uptrend.

Such a significant change in candle size should always get the attention of traders because it indicates a major shift in the buyer-seller dynamic.

#4 Engulfing Continuation

Engulfing candlesticks can also be used as a continuation signal.

The price had just broken out of the range to start a new downtrend when the price gave a short corrective wave. The price always moves in ways and during corrective phases, it can pay off to look for continuation signals.

The two bullish candles were small in size, indicating that the bulls were extremely weak and could not get the price higher. Suddenly, the trend continued with a bearish engulfing candle. The break-away with the engulfing candle signaled that the bulls have withdrawn and that the bears are now continuing the downtrend.

As indicated above, paying attention to candle size during a trend and corrective waves is a great way to improve your chart reading skills.

#5 Engulfing Pullback

Did I say that the engulfing pattern is extremely versatile?

In this example, I used a 50 EMA as a trend-following tool. The price was always above the EMA, indicating a bullish trend. During a bullish trend, traders should look for buying opportunities.

The best pullback opportunities usually exist when the price moves back into the moving average and then provides a strong signal. Keep in mind that trading the touch of a moving average is not enough but by adding multiple confluence factors to your decision-making, the chances for picking the right direction may increase.

When the price hit the EMA in the example below, the price also formed a strong engulfing candlestick pattern. The correct wave, at this point, had been going on for a while and the pullback then offered a much better price for the buyers to get into new trades.

#6 Double Top Fakeout

The fakeout pattern is also often referred to as a trap candlestick pattern but the idea is the same.

In the example below, the uptrend made a local high initially and during the next attempt to continue the trend, the price failed to reach a higher high. The price was immediately rejected as soon as it reached the previous high.

This pattern is a clear indication that the prevailing trend is likely to be over because the buyers lack the power to continue making higher highs.

#7 Triple Tap Exhaustion

The triple tap is a powerful reversal pattern as it indicates a loss in trend momentum.